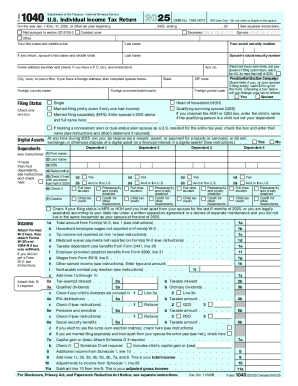

IRS 1040 2014 free printable template

Instructions and Help about IRS 1040

How to edit IRS 1040

How to fill out IRS 1040

About IRS previous version

What is IRS 1040?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

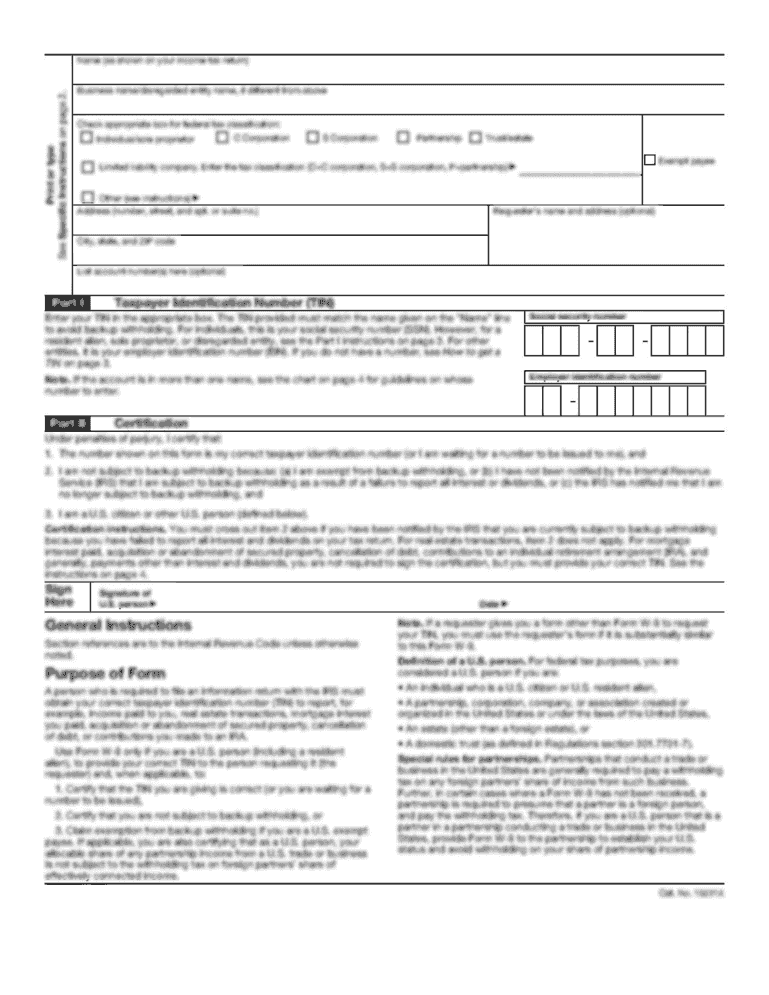

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1040

What should I do if I made a mistake on my IRS 1040 after filing?

If you've realized an error on your IRS 1040 after submission, you can correct it by filing Form 1040-X, the Amended U.S. Individual Income Tax Return. Make sure to provide clear explanations of the changes and include any supporting documents. Note that processing of amended returns can take several months, so keep an eye on the status and ensure it's correctly received.

How can I check the status of my IRS 1040 after submission?

You can check the status of your IRS 1040 by using the IRS 'Where's My Refund?' tool on their website. You'll need your Social Security number, filing status, and the exact refund amount to obtain the current status. It helps to verify receipt and processing of your submission efficiently.

What are some common errors made on the IRS 1040 and how can I avoid them?

Common errors on the IRS 1040 include incorrect Social Security numbers, mismatched names, and arithmetic mistakes. To avoid these, double-check your entries before submission, use tax preparation software with built-in checks, and ensure that all forms and attachments are accurate and correctly filled.

How long should I keep records related to my IRS 1040?

It's recommended to keep your records related to IRS 1040 for at least three years from the date you filed your return or the due date of the return, whichever is later. This helps in case the IRS has questions or conducts an audit regarding your tax filings.

Can I use e-signatures for my IRS 1040 and what are the security precautions?

Yes, e-signatures are accepted for IRS 1040 filings submitted electronically. Ensure you use secure platforms and verify that the e-signature service complies with IRS regulations to protect your sensitive information and maintain data security.

See what our users say