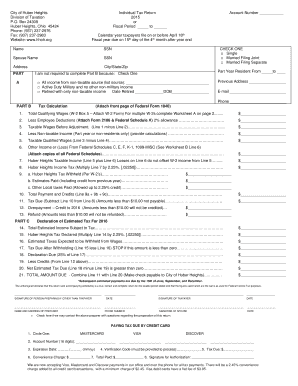

If there’s one type of IRS form that most Americans are familiar with, it’s Form 1040, the US Individual Income Tax Return. The 1040 form allows you to calculate and report your “Adjusted Gross Income”, or AGI, for the tax year, including all sources of income, from wages to dividends to refunds. Although most Americans are familiar with this form, many are often confused as to which version of the IRS form 1040 for 2014 they should use when filing the tax return – is it the 1040EZ, 1040A, or the full Form 1040?

These three forms differ in their requirements for who can use them as well as what kinds of income adjustments they allow you to report.

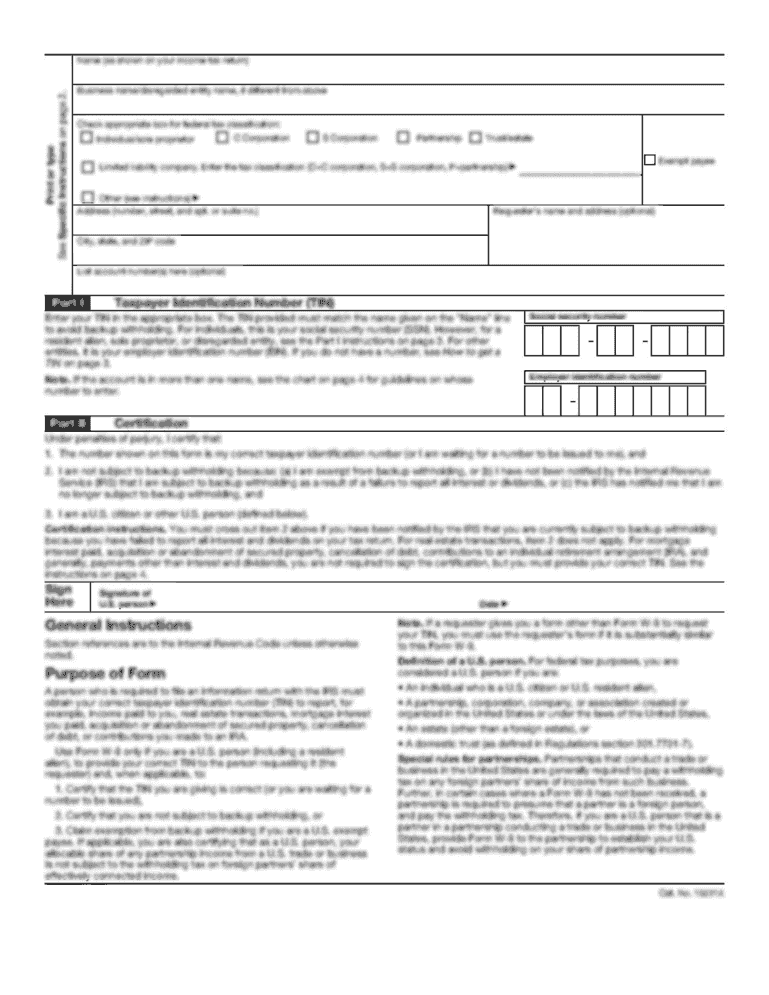

Form 1040 is the full version and allows for any kind of credit or deduction, has no limit on income level, permits itemized deductions, and allows for attached schedules to detail more complex tax situations. It is the longest version and may allow you to get larger refunds if done correctly.

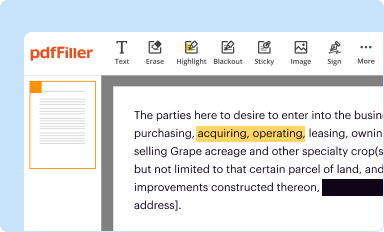

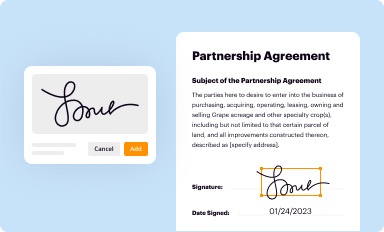

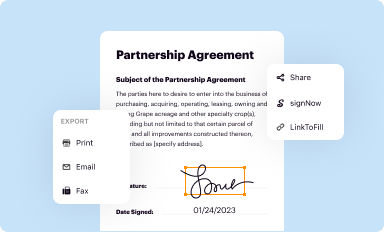

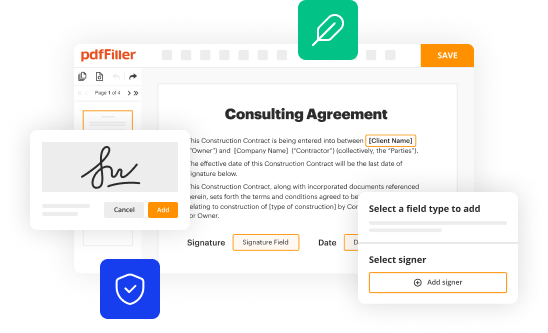

PDFfiller can make filling out the Form 1040 you choose to use much easier! Use our online editor to get ahead of the game and begin filling out your tax return instantly. See the video below if you need more help deciding which form is right for your tax situation.